The Intersection of Health, Wellness, and Financial Empowerment

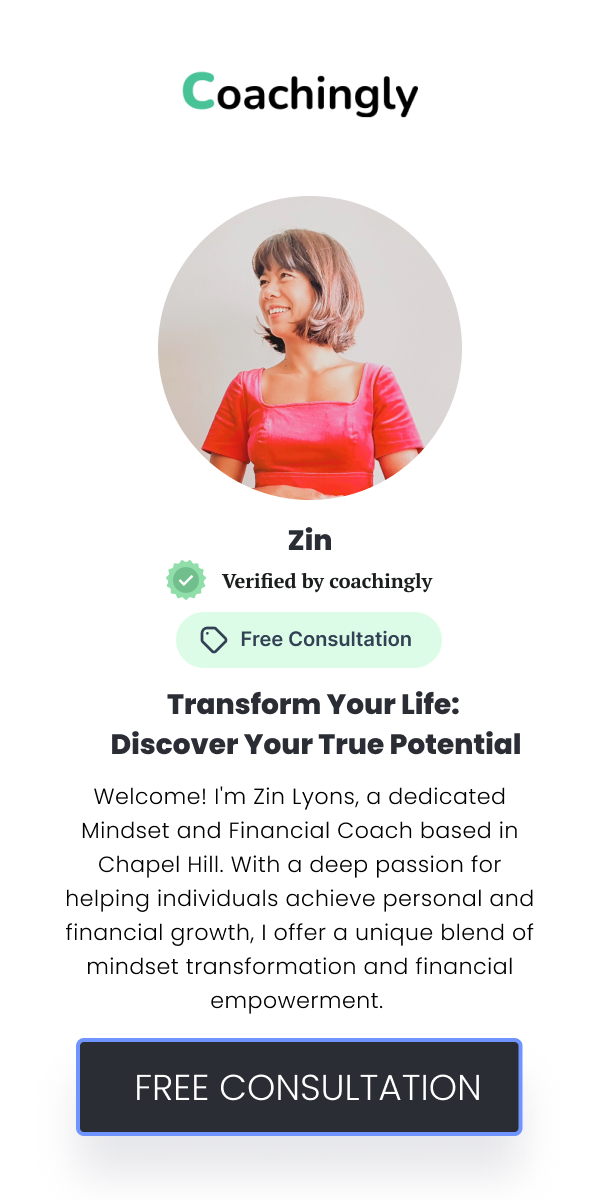

![]() Zin Lyons

Zin Lyons

![]() August 29, 2024

August 29, 2024

Health and financial well-being are deeply interconnected, each influencing the other in significant ways. Financial stability, often defined by the ability to manage expenses and save for future needs, impacts one's physical and mental health. When financial pressures become overwhelming, they can manifest as stress, anxiety, or even physical ailments such as hypertension and insomnia. Conversely, poor health can limit one's earning potential and lead to increased medical expenses, creating a vicious cycle that exacerbates financial strain. Understanding this dynamic is crucial for developing effective strategies to enhance both financial stability and overall health. Financial stress has notable psychological effects that can impact well-being. Constant financial worry can lead to chronic stress, which negatively affects mental health and reduces quality of life. Over time, this stress can cause emotional exhaustion and contribute to conditions such as depression or anxiety. The continuous pressure to meet financial obligations can impair one's ability to enjoy life and maintain a positive outlook. Therefore, addressing financial concerns is not only a matter of monetary importance but also a key component of mental and physical wellness. Incorporating wellness into financial planning can significantly enhance one's ability to achieve financial empowerment. Wellness practices, such as mindfulness and stress management, can improve clarity and focus, aiding in better financial decision-making. By promoting a balanced approach to both personal health and finances, individuals can set more achievable financial goals that align with their overall well-being. Wellness supports a holistic view of financial planning, helping individuals manage their finances in a way that supports their values and lifestyle. Integrating wellness strategies into financial planning involves creating a synergy between personal health and financial goals. Mindfulness, for example, can help individuals make more thoughtful financial choices by reducing impulsive spending and increasing awareness of their financial habits. Establishing wellness practices such as regular exercise and balanced nutrition can also contribute to improved financial management, as individuals with better physical health are often more productive and less likely to experience financial setbacks due to health issues. Adopting a balanced approach ensures that financial goals are realistic and sustainable, promoting long-term success and satisfaction. Financial coaching plays a vital role in promoting both financial and personal well-being. A skilled financial coach helps clients navigate the complex landscape of financial planning while considering their overall health and wellness. By focusing on the interplay between financial stability and personal health, coaches provide tailored advice that addresses both immediate financial concerns and long-term wellness goals. This comprehensive approach ensures that clients develop strategies that support their overall quality of life, rather than just their financial status. The benefits of combining financial coaching with wellness practices are substantial. Financial coaches often employ techniques that align with wellness principles, such as goal-setting and habit formation, to foster a more integrated approach to managing both finances and health. For instance, financial coaches may work with clients to establish sustainable financial habits that promote both economic security and personal well-being. This integrative method not only helps clients achieve their financial goals but also enhances their overall health and life satisfaction, demonstrating the value of a holistic approach to financial coaching. Developing a balanced financial plan requires attention to both financial and personal well-being. A comprehensive financial plan includes essential elements such as budgeting, saving, and investing, all of which should align with personal values and wellness goals. Creating a budget that incorporates health-related expenses, such as gym memberships or medical costs, ensures that financial planning supports overall well-being. Setting realistic financial goals that consider personal health needs helps individuals maintain a balanced approach, reducing the risk of financial stress and promoting a healthier lifestyle. Incorporating wellness into daily financial habits involves creating routines that support both health and financial stability. Simple practices, such as tracking spending, setting financial goals, and maintaining a healthy lifestyle, can significantly impact one's ability to manage finances effectively. Tools such as budgeting apps or financial planning resources can help individuals stay organised and on track with their financial and wellness goals. By integrating these practices into daily life, individuals can achieve a harmonious balance that enhances both their financial security and personal well-being. Emerging trends in health and financial integration are shaping the future of financial coaching and wellness. Innovations such as digital health tools and advanced financial planning technologies are making it easier for individuals to manage both aspects of their lives simultaneously. These advancements offer new opportunities for personalised and holistic approaches to financial coaching that consider wellness as a fundamental component. As the field continues to evolve, individuals can expect increasingly sophisticated methods for achieving financial and personal balance. Preparing for a balanced future involves adopting long-term strategies that support both health and financial stability. Continuous personal development, including ongoing education in financial management and wellness practices, is essential for maintaining this balance. Embracing new trends and technologies can provide valuable resources and insights for achieving and sustaining financial empowerment. By focusing on both immediate needs and long-term goals, individuals can create a more stable and fulfilling future, ensuring that their financial and personal well-being are aligned and supported.Understanding the Connection Between Health and Financial Stability

The Role of Wellness in Achieving Financial Empowerment

Financial Coaching as a Pathway to Health and Wellness

Practical Steps to Achieve Balance in Health, Wellness, and Finances

The Future of Integrated Health and Financial Empowerment

Recent Articles

Creating Lasting Change: The Importance of Self-Identity in Personal Development

The Role of Self-Identity in P...

![]() Sep 03, 2024

Sep 03, 2024

The Power of Mindset: Overcoming Limiting Beliefs for Personal Growth

Understanding Limiting Beliefs...

![]() Sep 02, 2024

Sep 02, 2024

Navigating Financial Challenges: Proven Methods for Overcoming Barriers

Financial challenges can feel ...

![]() Sep 01, 2024

Sep 01, 2024

Why Empathy and Active Listening Are Crucial in Coaching Relationships

The Role of Empathy in Coachin...

![]() Aug 31, 2024

Aug 31, 2024

Mastering Money Mindset: How Your Beliefs Impact Your Financial Decisions

Understanding how your mindset...

![]() Aug 30, 2024

Aug 30, 2024

How Mindset Coaching Can Help You Find Fulfilment in Your Career

Mindset coaching is an innovat...

![]() Aug 28, 2024

Aug 28, 2024

Achieving Work-Life Balance with Mindset and Financial Coaching

The Importance of Work-Life Ba...

![]() Aug 27, 2024

Aug 27, 2024

Unlock Your Potential: How Mindset Coaching Can Transform Your Life

Understanding Mindset Coaching...

![]() Aug 26, 2024

Aug 26, 2024

From Debt to Wealth: Transformative Financial Strategies for Lasting Change

Understanding the Debt CycleDe...

![]() Aug 25, 2024

Aug 25, 2024

Developing Resilience Through Mindset Coaching: Lessons from a Former Nurse and Soldier

The Power of Resilience in Per...

![]() Aug 24, 2024

Aug 24, 2024

Financial Freedom Starts Here: Essential Tips from a Financial Coach

Understanding Financial Freedo...

![]() Aug 23, 2024

Aug 23, 2024

The Role of Self-Reflection in Mindset Transformation

Understanding Self-ReflectionS...

![]() Aug 22, 2024

Aug 22, 2024

How to Create Effective Spending and Saving Goals That Align with Your Values

Understanding the Importance o...

![]() Aug 21, 2024

Aug 21, 2024

Breaking Through Barriers: How Mindset Coaching Helps You Achieve Your Dreams

The Power of Mindset in Achiev...

![]() Aug 20, 2024

Aug 20, 2024

Setting Healthy Boundaries for Personal Growth: Insights from a Mindset Coach

Understanding the Concept of B...

![]() Aug 19, 2024

Aug 19, 2024

The Benefits of Combining Mindset and Financial Coaching for Holistic Success

Achieving true success involve...

![]() Aug 18, 2024

Aug 18, 2024

Building Confidence Through Mindset Coaching: Strategies for Success

Understanding Mindset Coaching...

![]() Aug 17, 2024

Aug 17, 2024

Personal Development Through Financial Coaching: What You Need to Know

The Role of a Financial Coach ...

![]() Aug 16, 2024

Aug 16, 2024

Practical Steps for Building Wealth: Financial Coaching Strategies That Work

Understanding Wealth BuildingW...

![]() Aug 15, 2024

Aug 15, 2024

Transform Your Financial Life: Key Principles for Effective Budgeting and Investing

Understanding Financial Transf...

![]() Aug 14, 2024

Aug 14, 2024

Aligning Your Values with Financial Goals: A Guide to Financial Wellness

Understanding the Connection B...

![]() Aug 13, 2024

Aug 13, 2024

The Essential Guide to Financial Coaching: Unlocking Your Path to Financial Wellness

Understanding Financial Coachi...

![]() Aug 12, 2024

Aug 12, 2024