Practical Steps for Building Wealth: Financial Coaching Strategies That Work

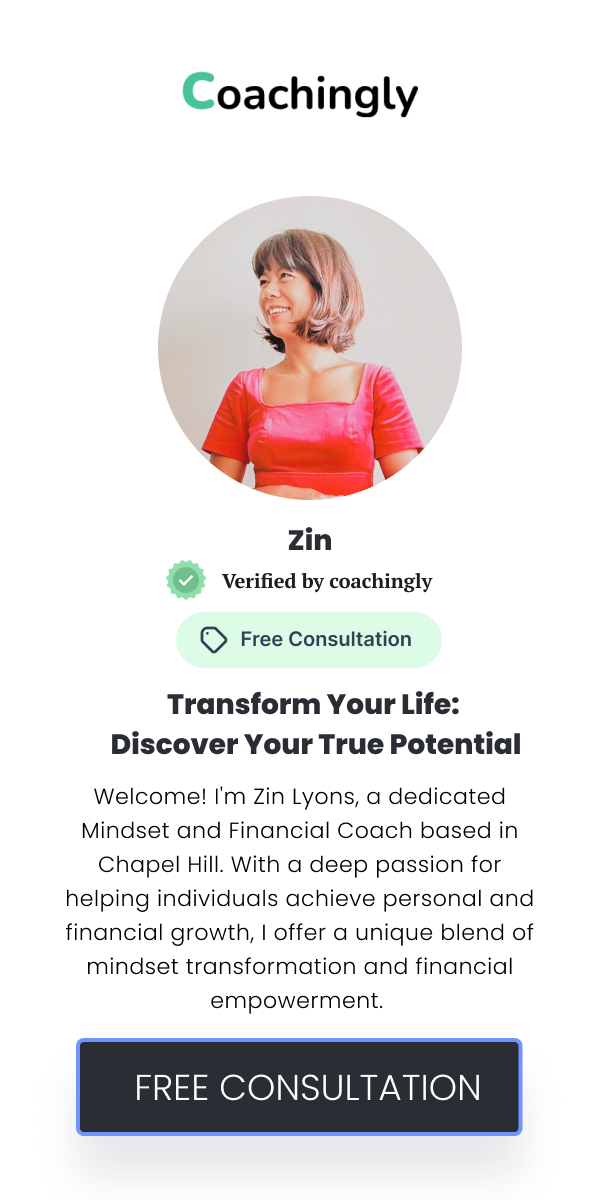

![]() Zin Lyons

Zin Lyons

![]() August 15, 2024

August 15, 2024

Wealth building is more than just accumulating money; it's about creating a sustainable and prosperous financial future. At its core, wealth building involves strategic planning, disciplined saving, and smart investing. A financial coach plays a pivotal role in this journey by offering tailored guidance and expert advice. They help you understand complex financial concepts and develop actionable strategies that align with your personal goals. By partnering with a financial coach, you gain access to a wealth of knowledge and a structured approach that can accelerate your financial growth. This professional support is invaluable in navigating the often overwhelming process of wealth building. The right coach can turn abstract financial goals into tangible results, making the path to financial security clearer and more achievable. Before embarking on a wealth-building journey, it's essential to assess your current financial health. Start by evaluating your net worth, which is the difference between your assets and liabilities. This provides a snapshot of your financial standing and helps identify areas for improvement. Next, scrutinize your income and expenses to understand your cash flow. Creating a detailed record of your spending habits will highlight areas where you can cut costs and increase savings. Setting clear and realistic financial goals is the next crucial step. Define both short-term objectives, such as saving for a holiday, and long-term targets, like retirement planning. This process will set a solid foundation for your financial strategy, guiding your actions and decisions towards achieving your wealth-building ambitions. Developing a personal financial plan is a key step in achieving financial stability and building wealth. Start by crafting a comprehensive budget that outlines your income and expenses. This budget should be realistic and reflect your financial goals. Effective budgeting helps you manage your money efficiently, ensuring that you are saving and investing appropriately. Addressing debt is another critical component of your financial plan. Employ strategies like snowball or avalanche methods to reduce outstanding liabilities systematically. Additionally, establishing a robust savings and investment plan will contribute significantly to your wealth-building efforts. Allocate a portion of your income to savings and explore various investment options, such as stocks, bonds, and real estate, to grow your wealth over time. Investing wisely is central to building wealth and securing financial freedom. Begin by understanding the fundamentals of different investment types, including stocks, bonds, and real estate. Each investment comes with its own set of risks and rewards, and it's important to choose options that align with your financial goals and risk tolerance. Effective risk management is crucial in protecting your investments. Diversifying your portfolio across various asset classes can help mitigate potential losses and maximize returns. Diversification spreads your investments across different sectors and geographical regions, reducing the impact of any single investment's poor performance on your overall portfolio. By employing these strategies, you can build a resilient and profitable investment portfolio that supports your long-term financial objectives. Improving your financial literacy is an ongoing process that enhances your ability to make informed financial decisions. Continuously seek out resources to deepen your understanding of financial concepts and market trends. Books, online courses, and financial news are excellent sources of information that can keep you updated on current financial practices. Utilizing financial tools and resources can also aid in managing your finances more effectively. Budgeting apps, investment trackers, and financial planning software can simplify the process of monitoring your financial health and progress. By staying informed and leveraging these tools, you can make more strategic decisions that contribute to your wealth-building goals. Regularly investing time in learning about personal finance will empower you to navigate your financial journey with confidence and competence. A financial coach can significantly enhance your wealth-building efforts by providing personalized guidance and support. Financial coaches help you set achievable goals, develop strategic plans, and overcome obstacles. They bring an expert perspective to your financial situation, helping you make well-informed decisions that align with your objectives. Choosing the right financial coach involves evaluating their experience, expertise, and compatibility with your financial goals. Look for a coach who has a proven track record in financial planning and a coaching style that resonates with you. Effective coaching involves regular check-ins and adjustments to your financial plan based on your progress and changing circumstances. By leveraging a financial coach, you gain valuable insights and accountability that can accelerate your path to financial success. Maintaining financial discipline is crucial for achieving and sustaining wealth. Regularly reviewing and adjusting your financial plan ensures that you stay on track with your goals and adapt to any changes in your financial situation. Set aside time for periodic financial reviews to assess your progress, reassess your goals, and make necessary adjustments. Overcoming financial challenges requires resilience and persistence. Develop strategies to stay motivated, such as setting incremental goals and celebrating small victories along the way. Implementing these practices helps you stay focused and committed to your financial objectives. By cultivating a disciplined approach to managing your finances, you build a strong foundation for long-term wealth and financial stability.Understanding Wealth Building

Assessing Your Current Financial Situation

Creating a Personal Financial Plan

Building Wealth Through Smart Investing

Enhancing Financial Literacy

Leveraging Financial Coaching

Maintaining Financial Discipline

Recent Articles

Creating Lasting Change: The Importance of Self-Identity in Personal Development

The Role of Self-Identity in P...

![]() Sep 03, 2024

Sep 03, 2024

The Power of Mindset: Overcoming Limiting Beliefs for Personal Growth

Understanding Limiting Beliefs...

![]() Sep 02, 2024

Sep 02, 2024

Navigating Financial Challenges: Proven Methods for Overcoming Barriers

Financial challenges can feel ...

![]() Sep 01, 2024

Sep 01, 2024

Why Empathy and Active Listening Are Crucial in Coaching Relationships

The Role of Empathy in Coachin...

![]() Aug 31, 2024

Aug 31, 2024

Mastering Money Mindset: How Your Beliefs Impact Your Financial Decisions

Understanding how your mindset...

![]() Aug 30, 2024

Aug 30, 2024

The Intersection of Health, Wellness, and Financial Empowerment

Understanding the Connection B...

![]() Aug 29, 2024

Aug 29, 2024

How Mindset Coaching Can Help You Find Fulfilment in Your Career

Mindset coaching is an innovat...

![]() Aug 28, 2024

Aug 28, 2024

Achieving Work-Life Balance with Mindset and Financial Coaching

The Importance of Work-Life Ba...

![]() Aug 27, 2024

Aug 27, 2024

Unlock Your Potential: How Mindset Coaching Can Transform Your Life

Understanding Mindset Coaching...

![]() Aug 26, 2024

Aug 26, 2024

From Debt to Wealth: Transformative Financial Strategies for Lasting Change

Understanding the Debt CycleDe...

![]() Aug 25, 2024

Aug 25, 2024

Developing Resilience Through Mindset Coaching: Lessons from a Former Nurse and Soldier

The Power of Resilience in Per...

![]() Aug 24, 2024

Aug 24, 2024

Financial Freedom Starts Here: Essential Tips from a Financial Coach

Understanding Financial Freedo...

![]() Aug 23, 2024

Aug 23, 2024

The Role of Self-Reflection in Mindset Transformation

Understanding Self-ReflectionS...

![]() Aug 22, 2024

Aug 22, 2024

How to Create Effective Spending and Saving Goals That Align with Your Values

Understanding the Importance o...

![]() Aug 21, 2024

Aug 21, 2024

Breaking Through Barriers: How Mindset Coaching Helps You Achieve Your Dreams

The Power of Mindset in Achiev...

![]() Aug 20, 2024

Aug 20, 2024

Setting Healthy Boundaries for Personal Growth: Insights from a Mindset Coach

Understanding the Concept of B...

![]() Aug 19, 2024

Aug 19, 2024

The Benefits of Combining Mindset and Financial Coaching for Holistic Success

Achieving true success involve...

![]() Aug 18, 2024

Aug 18, 2024

Building Confidence Through Mindset Coaching: Strategies for Success

Understanding Mindset Coaching...

![]() Aug 17, 2024

Aug 17, 2024

Personal Development Through Financial Coaching: What You Need to Know

The Role of a Financial Coach ...

![]() Aug 16, 2024

Aug 16, 2024

Transform Your Financial Life: Key Principles for Effective Budgeting and Investing

Understanding Financial Transf...

![]() Aug 14, 2024

Aug 14, 2024

Aligning Your Values with Financial Goals: A Guide to Financial Wellness

Understanding the Connection B...

![]() Aug 13, 2024

Aug 13, 2024

The Essential Guide to Financial Coaching: Unlocking Your Path to Financial Wellness

Understanding Financial Coachi...

![]() Aug 12, 2024

Aug 12, 2024