Navigating Financial Challenges: Proven Methods for Overcoming Barriers

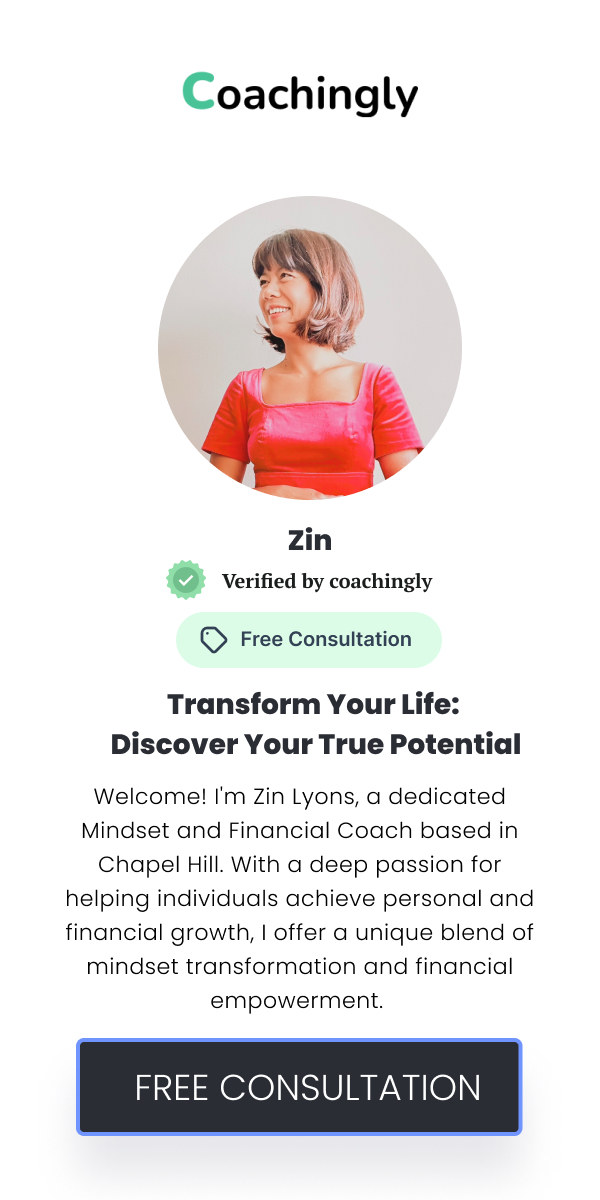

![]() Zin Lyons

Zin Lyons

![]() September 01, 2024

September 01, 2024

Financial challenges can feel overwhelming, but understanding and addressing these barriers can make a significant difference in achieving financial stability. By employing effective strategies and adopting a proactive approach, you can turn financial obstacles into manageable tasks. This article delves into proven methods for overcoming common financial hurdles and setting yourself on a path to financial well-being. Financial barriers come in various forms, from mounting debt to inadequate budgeting practices. One common issue is debt accumulation, which often results from overspending, unforeseen expenses, or poor financial planning. This can lead to a cycle of financial stress and hinder progress toward financial goals. Poor budgeting, another prevalent challenge, stems from an inability to track income and expenses effectively. Without a clear plan, it becomes difficult to manage spending and save for future needs. Additionally, limited financial literacy can exacerbate these problems. Many individuals lack comprehensive knowledge about managing money, which can lead to suboptimal financial decisions. Identifying these personal financial obstacles is crucial. By assessing your financial situation and recognising the emotional and behavioural factors affecting your finances, you can take the first step toward resolution. Managing debt is a critical component of overcoming financial challenges. Start by creating a realistic debt repayment plan. Prioritising high-interest debts can help reduce the overall cost of borrowing. Establish achievable repayment goals and stick to them. Negotiating with creditors is another effective strategy. Reach out to your creditors to discuss possible adjustments to your payment terms. They may be willing to offer more favourable conditions or help restructure your debt. Exploring debt relief options, such as consolidation or settlement, is also worth considering. Consolidation can simplify your debt by combining multiple payments into one, while settlement involves negotiating a reduced amount to settle your debt. Understanding the pros and cons of bankruptcy is essential as a last resort. Bankruptcy can offer relief but may have long-term effects on your credit. Effective budgeting and financial planning are fundamental in navigating financial challenges. Developing a comprehensive budget is a crucial first step. Begin by tracking your income and expenses meticulously. Categorise your spending to identify areas where you can cut back and set clear limits for each category. Utilising financial tools and apps can streamline this process. Numerous budgeting apps are available that automate expense tracking and provide insights into your spending habits. Establishing and achieving financial goals is another key aspect. Distinguish between short-term and long-term goals, and implement strategies to monitor your progress regularly. Regularly reviewing and adjusting your budget can help you stay on track and make necessary adjustments as your financial situation evolves. Building financial literacy is essential for effective money management. Numerous educational resources are available to increase your financial knowledge. Consider reading books on personal finance or enrolling in online courses that cover budgeting, investing, and financial planning. Participating in financial literacy workshops can also provide valuable insights and practical skills. Building a support network can further enhance your financial understanding. Joining financial communities or forums allows you to exchange experiences and advice with others facing similar challenges. Seeking advice from financial professionals can provide personalised guidance tailored to your specific needs. Engaging with these resources can significantly improve your financial literacy and decision-making skills. A positive financial mindset is vital for overcoming barriers and achieving financial success. Overcoming limiting beliefs about money is a crucial part of this process. Identify any negative beliefs you hold about finances and work on challenging and changing them. Developing a positive money mindset involves recognising and fostering a more constructive outlook on financial matters. Establishing good financial habits can support this mindset. Incorporate daily practices that promote financial health, such as regular savings and budgeting reviews. Regularly reviewing your financial situation can help you stay focused and make adjustments as needed. By maintaining a healthy financial mindset, you can navigate challenges more effectively and stay motivated towards achieving your financial goals. When navigating complex financial challenges, seeking professional guidance can be beneficial. If you find yourself struggling to manage your finances despite your best efforts, it may be time to consider working with a financial coach. Recognise the signs that indicate you might need professional help, such as persistent financial stress or difficulty achieving financial goals. A financial coach can provide expert assistance and personalised strategies to help you overcome barriers and improve your financial situation. Choosing the right financial coach involves evaluating their qualifications and experience. Look for a coach with relevant credentials and a proven track record in financial management. Working with a financial coach can provide valuable insights and support, helping you navigate financial challenges more effectively. Navigating financial challenges requires a comprehensive approach that includes managing debt, budgeting effectively, enhancing financial literacy, cultivating a positive mindset, and seeking professional guidance when needed. By applying these proven methods, you can address financial barriers and work towards achieving your financial goals with greater confidence and clarity.Understanding Financial Challenges

Strategies for Effective Debt Management

Mastering Budgeting and Financial Planning

Enhancing Financial Literacy and Awareness

Cultivating a Healthy Financial Mindset

Seeking Professional Guidance

Recent Articles

Creating Lasting Change: The Importance of Self-Identity in Personal Development

The Role of Self-Identity in P...

![]() Sep 03, 2024

Sep 03, 2024

The Power of Mindset: Overcoming Limiting Beliefs for Personal Growth

Understanding Limiting Beliefs...

![]() Sep 02, 2024

Sep 02, 2024

Why Empathy and Active Listening Are Crucial in Coaching Relationships

The Role of Empathy in Coachin...

![]() Aug 31, 2024

Aug 31, 2024

Mastering Money Mindset: How Your Beliefs Impact Your Financial Decisions

Understanding how your mindset...

![]() Aug 30, 2024

Aug 30, 2024

The Intersection of Health, Wellness, and Financial Empowerment

Understanding the Connection B...

![]() Aug 29, 2024

Aug 29, 2024

How Mindset Coaching Can Help You Find Fulfilment in Your Career

Mindset coaching is an innovat...

![]() Aug 28, 2024

Aug 28, 2024

Achieving Work-Life Balance with Mindset and Financial Coaching

The Importance of Work-Life Ba...

![]() Aug 27, 2024

Aug 27, 2024

Unlock Your Potential: How Mindset Coaching Can Transform Your Life

Understanding Mindset Coaching...

![]() Aug 26, 2024

Aug 26, 2024

From Debt to Wealth: Transformative Financial Strategies for Lasting Change

Understanding the Debt CycleDe...

![]() Aug 25, 2024

Aug 25, 2024

Developing Resilience Through Mindset Coaching: Lessons from a Former Nurse and Soldier

The Power of Resilience in Per...

![]() Aug 24, 2024

Aug 24, 2024

Financial Freedom Starts Here: Essential Tips from a Financial Coach

Understanding Financial Freedo...

![]() Aug 23, 2024

Aug 23, 2024

The Role of Self-Reflection in Mindset Transformation

Understanding Self-ReflectionS...

![]() Aug 22, 2024

Aug 22, 2024

How to Create Effective Spending and Saving Goals That Align with Your Values

Understanding the Importance o...

![]() Aug 21, 2024

Aug 21, 2024

Breaking Through Barriers: How Mindset Coaching Helps You Achieve Your Dreams

The Power of Mindset in Achiev...

![]() Aug 20, 2024

Aug 20, 2024

Setting Healthy Boundaries for Personal Growth: Insights from a Mindset Coach

Understanding the Concept of B...

![]() Aug 19, 2024

Aug 19, 2024

The Benefits of Combining Mindset and Financial Coaching for Holistic Success

Achieving true success involve...

![]() Aug 18, 2024

Aug 18, 2024

Building Confidence Through Mindset Coaching: Strategies for Success

Understanding Mindset Coaching...

![]() Aug 17, 2024

Aug 17, 2024

Personal Development Through Financial Coaching: What You Need to Know

The Role of a Financial Coach ...

![]() Aug 16, 2024

Aug 16, 2024

Practical Steps for Building Wealth: Financial Coaching Strategies That Work

Understanding Wealth BuildingW...

![]() Aug 15, 2024

Aug 15, 2024

Transform Your Financial Life: Key Principles for Effective Budgeting and Investing

Understanding Financial Transf...

![]() Aug 14, 2024

Aug 14, 2024

Aligning Your Values with Financial Goals: A Guide to Financial Wellness

Understanding the Connection B...

![]() Aug 13, 2024

Aug 13, 2024

The Essential Guide to Financial Coaching: Unlocking Your Path to Financial Wellness

Understanding Financial Coachi...

![]() Aug 12, 2024

Aug 12, 2024