How to Create Effective Spending and Saving Goals That Align with Your Values

![]() Zin Lyons

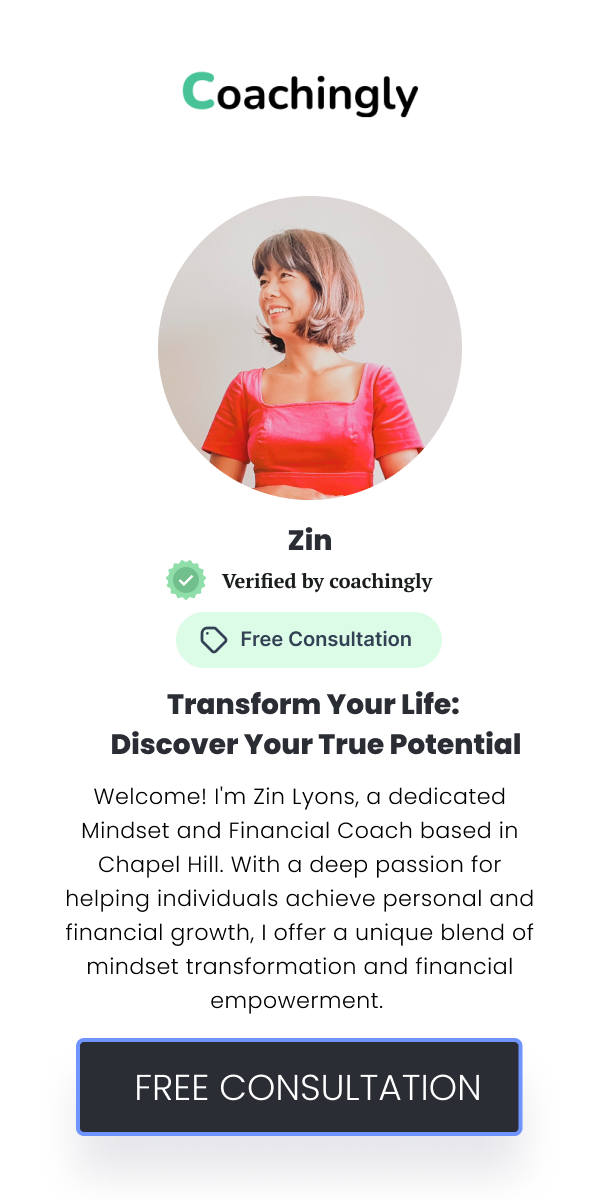

Zin Lyons

![]() August 21, 2024

August 21, 2024

Aligning your financial goals with your values is crucial for creating a sense of fulfillment and purpose in your financial journey. When your spending and saving habits reflect what you truly care about, it enhances your motivation to stick to your financial plans and can lead to more satisfying outcomes. Misalignment, on the other hand, often results in frustration and a lack of progress, as financial goals may not resonate deeply with your true priorities. For instance, spending on luxury items that don't align with your values might lead to temporary satisfaction but can eventually cause financial strain. On the contrary, aligning your financial goals with your core beliefs ensures that your financial decisions support a lifestyle that feels authentic and rewarding. Embracing this alignment helps to avoid the pitfalls of financial stress and dissatisfaction, leading to a more balanced and content life. The key is to ensure that every financial decision you make reflects what truly matters to you, promoting both financial health and personal well-being. Discovering your core values is the first step toward creating effective spending and saving goals. Core values are fundamental beliefs that guide your behavior and decision-making processes. Techniques such as self-reflection exercises, value assessment tools, and even discussions with trusted friends can help uncover what you truly value. For example, you might realize that security, family, or creativity are central to your decision-making. Distinguishing between these core values and transient desires is vital for crafting financial goals that are both meaningful and achievable. Values such as environmental sustainability or financial independence might shape how you prioritize your spending and savings. By identifying these core values, you can ensure that your financial planning supports a lifestyle that is both purposeful and aligned with your deepest beliefs. This clarity provides a solid foundation for making decisions that are both satisfying and sustainable in the long run. Establishing specific, measurable, and achievable financial goals is essential for effectively managing your finances in line with your values. Clearly defined objectives help to create a roadmap for your financial journey, making it easier to track progress and make adjustments as needed. For example, if financial security is a core value, setting a goal to build an emergency fund equivalent to three months' expenses aligns with this priority. Integrating personal values into both short-term and long-term financial planning ensures that your goals resonate deeply and keep you motivated. Short-term goals might include saving for a vacation that aligns with your love for travel, while long-term goals could focus on investing in education or home ownership. By setting goals that reflect your values, you can achieve a more cohesive financial plan that supports your overall life objectives. Regularly revisiting and refining these goals ensures that they remain relevant and aligned with your evolving values. Creating a budget that honors your values requires thoughtful planning and a commitment to aligning your spending with what matters most. Begin by listing your essential expenses, such as housing, utilities, and groceries, alongside discretionary spending categories. Ensuring that your budget accommodates both necessary expenses and value-driven spending helps maintain a balanced approach. Tools such as budgeting apps and spreadsheets can assist in tracking your income and expenses, providing a clear picture of where your money is going. Prioritizing spending in areas that reflect your values, like charitable donations or experiences over material goods, can enhance the satisfaction derived from your financial decisions. Allocating funds for savings goals that support your values, such as a retirement fund or educational investments, is equally important. This approach not only helps manage your finances effectively but also ensures that every pound spent contributes to a fulfilling and value-driven life. Effective saving strategies are key to achieving financial wellness and aligning your savings with your values. Start by setting up specific savings goals that resonate with your core values, such as creating a fund for personal development or environmental initiatives. Explore different types of savings accounts and investment options that align with your values, such as ethical investment funds or high-yield savings accounts. Automating your savings, such as setting up regular transfers to a savings account, ensures consistency and reduces the temptation to spend. Implementing strategies like the 50/30/20 rule, which allocates 50% of your income to necessities, 30% to discretionary spending, and 20% to savings, can help maintain a balanced approach. Regularly reviewing your savings goals and adjusting them as needed helps to stay aligned with your evolving values and financial situation. By employing these strategies, you can build a solid financial foundation that supports both your immediate and long-term aspirations. Making spending decisions that reflect your values involves evaluating each purchase and investment through the lens of what truly matters to you. Start by assessing whether a potential expenditure aligns with your core values and contributes to your overall financial goals. For instance, investing in experiences that bring joy and personal growth may be more fulfilling than purchasing luxury items that offer fleeting satisfaction. Strategies such as creating a spending plan that prioritizes value-driven expenses can help manage your budget effectively. Avoiding impulse buying and practicing mindful spending ensures that each purchase supports your financial and personal objectives. Establishing clear criteria for evaluating purchases can prevent regret and ensure that your spending aligns with your values. Regularly revisiting your spending habits and adjusting them as needed can maintain a focus on what truly enriches your life and aligns with your financial goals. This deliberate approach enhances both financial stability and personal satisfaction. Regularly assessing and updating your financial plan is crucial for maintaining alignment with your values as circumstances and priorities evolve. Schedule periodic reviews of your financial goals, budget, and savings strategies to ensure they continue to reflect your current values and life situation. Adjusting your financial plan in response to changes, such as a new job, a significant life event, or shifts in your core values, helps to keep your plan relevant and effective. Tools and techniques, such as financial tracking apps or consulting with a financial coach, can provide valuable insights and facilitate adjustments. Staying flexible and open to change ensures that your financial plan remains a true reflection of your values and goals. By regularly reviewing and refining your approach, you can achieve ongoing success and satisfaction in your financial journey. This proactive approach helps maintain financial alignment and supports long-term personal and financial well-being. Consulting a financial coach can offer significant benefits in aligning your spending and saving goals with your values. A financial coach provides expert guidance on setting and achieving financial objectives that resonate with your personal beliefs. They can help you develop a tailored financial plan that integrates your values into your budgeting, saving, and investing strategies. Choosing the right financial coach involves finding someone who understands your values and goals and can offer personalized support. A financial coach can also assist in overcoming financial challenges and maintaining a focus on value-driven decisions. By working with a coach, you gain access to professional expertise and insights that enhance your financial planning. This support ensures that your financial journey is aligned with your values and optimized for achieving your personal and financial aspirations. Creating an environment that supports your financial goals involves surrounding yourself with resources and people who align with your values. Engaging with like-minded individuals and communities can provide encouragement and accountability in your financial journey. Leveraging resources such as financial planning tools, educational materials, and support groups can enhance your ability to maintain value-driven financial habits. Establishing a supportive environment helps to reinforce your commitment to achieving financial goals that reflect your core values. Regular interactions with supportive friends and family members can also provide motivation and guidance. By cultivating a positive financial environment, you enhance your ability to stay aligned with your values and achieve your financial aspirations. This approach contributes to a more fulfilling and balanced financial journey.Understanding the Importance of Aligning Financial Goals with Personal Values

Identifying Your Core Values

Setting Clear Financial Objectives

Developing a Budget that Reflects Your Values

Implementing Effective Saving Strategies

Making Value-Driven Spending Decisions

Reviewing and Adjusting Your Financial Plan

Seeking Professional Guidance

Building a Supportive Financial Environment

Recent Articles

Creating Lasting Change: The Importance of Self-Identity in Personal Development

The Role of Self-Identity in P...

![]() Sep 03, 2024

Sep 03, 2024

The Power of Mindset: Overcoming Limiting Beliefs for Personal Growth

Understanding Limiting Beliefs...

![]() Sep 02, 2024

Sep 02, 2024

Navigating Financial Challenges: Proven Methods for Overcoming Barriers

Financial challenges can feel ...

![]() Sep 01, 2024

Sep 01, 2024

Why Empathy and Active Listening Are Crucial in Coaching Relationships

The Role of Empathy in Coachin...

![]() Aug 31, 2024

Aug 31, 2024

Mastering Money Mindset: How Your Beliefs Impact Your Financial Decisions

Understanding how your mindset...

![]() Aug 30, 2024

Aug 30, 2024

The Intersection of Health, Wellness, and Financial Empowerment

Understanding the Connection B...

![]() Aug 29, 2024

Aug 29, 2024

How Mindset Coaching Can Help You Find Fulfilment in Your Career

Mindset coaching is an innovat...

![]() Aug 28, 2024

Aug 28, 2024

Achieving Work-Life Balance with Mindset and Financial Coaching

The Importance of Work-Life Ba...

![]() Aug 27, 2024

Aug 27, 2024

Unlock Your Potential: How Mindset Coaching Can Transform Your Life

Understanding Mindset Coaching...

![]() Aug 26, 2024

Aug 26, 2024

From Debt to Wealth: Transformative Financial Strategies for Lasting Change

Understanding the Debt CycleDe...

![]() Aug 25, 2024

Aug 25, 2024

Developing Resilience Through Mindset Coaching: Lessons from a Former Nurse and Soldier

The Power of Resilience in Per...

![]() Aug 24, 2024

Aug 24, 2024

Financial Freedom Starts Here: Essential Tips from a Financial Coach

Understanding Financial Freedo...

![]() Aug 23, 2024

Aug 23, 2024

The Role of Self-Reflection in Mindset Transformation

Understanding Self-ReflectionS...

![]() Aug 22, 2024

Aug 22, 2024

Breaking Through Barriers: How Mindset Coaching Helps You Achieve Your Dreams

The Power of Mindset in Achiev...

![]() Aug 20, 2024

Aug 20, 2024

Setting Healthy Boundaries for Personal Growth: Insights from a Mindset Coach

Understanding the Concept of B...

![]() Aug 19, 2024

Aug 19, 2024

The Benefits of Combining Mindset and Financial Coaching for Holistic Success

Achieving true success involve...

![]() Aug 18, 2024

Aug 18, 2024

Building Confidence Through Mindset Coaching: Strategies for Success

Understanding Mindset Coaching...

![]() Aug 17, 2024

Aug 17, 2024

Personal Development Through Financial Coaching: What You Need to Know

The Role of a Financial Coach ...

![]() Aug 16, 2024

Aug 16, 2024

Practical Steps for Building Wealth: Financial Coaching Strategies That Work

Understanding Wealth BuildingW...

![]() Aug 15, 2024

Aug 15, 2024

Transform Your Financial Life: Key Principles for Effective Budgeting and Investing

Understanding Financial Transf...

![]() Aug 14, 2024

Aug 14, 2024

Aligning Your Values with Financial Goals: A Guide to Financial Wellness

Understanding the Connection B...

![]() Aug 13, 2024

Aug 13, 2024

The Essential Guide to Financial Coaching: Unlocking Your Path to Financial Wellness

Understanding Financial Coachi...

![]() Aug 12, 2024

Aug 12, 2024