From Debt to Wealth: Transformative Financial Strategies for Lasting Change

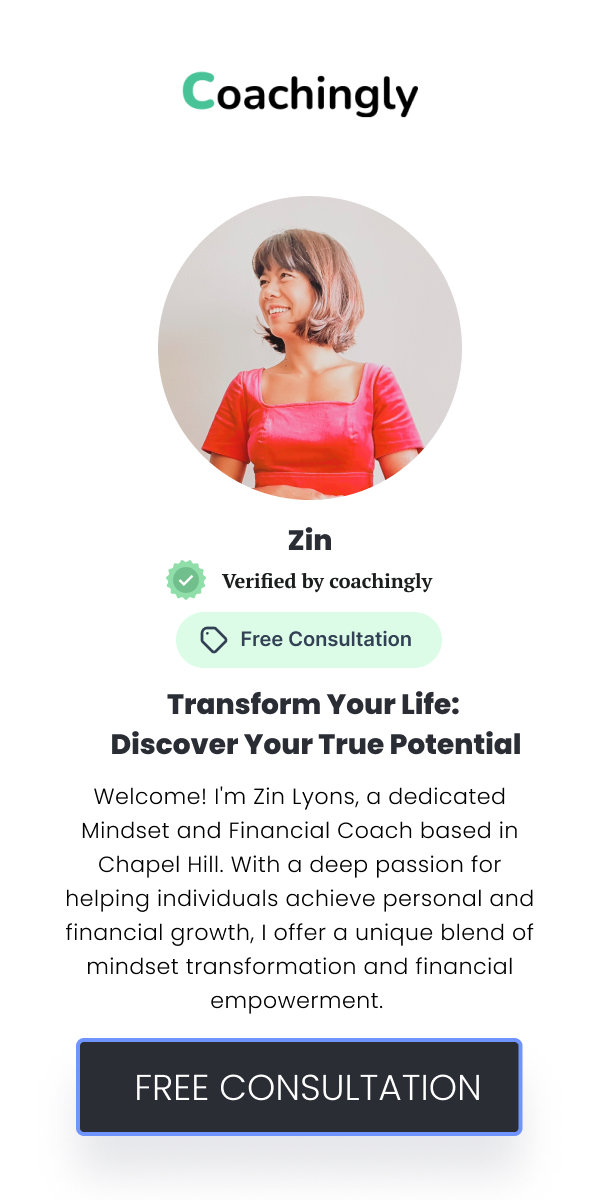

![]() Zin Lyons

Zin Lyons

![]() August 25, 2024

August 25, 2024

Debt can feel like a heavy burden, especially when it spirals out of control. Various forms of debt, including credit card balances, student loans, and personal loans, can lead to a cycle of stress and financial instability. Understanding how these debts impact your daily life is crucial for breaking free from their grip. The psychological toll of debt can lead to increased anxiety and feelings of helplessness, which in turn can affect both your personal and professional life. Identifying your personal debt patterns is the first step towards regaining control. Reflect on your spending habits and financial behaviours to understand how they contribute to your debt. By recognising these patterns, you can take proactive steps to address them and pave the way for a healthier financial future. Before embarking on a journey from debt to wealth, it's essential to assess your current financial situation comprehensively. This involves taking stock of all your assets, liabilities, income, and expenses. Establishing clear financial goals is pivotal; these goals should be specific, measurable, and time-bound. Short-term goals might include paying off a credit card balance, while long-term goals could involve saving for retirement or buying a home. Creating a vision for wealth building means defining what financial success looks like for you and setting milestones to achieve it. This vision serves as a motivational anchor, guiding your decisions and actions toward achieving a more secure financial future. With a clear understanding of your financial standing and goals, you're ready to implement strategies that will lead to lasting change. Effective debt management is key to transitioning from debt to financial freedom. Two popular methods for tackling debt are the debt snowball and debt avalanche techniques. The debt snowball method involves paying off the smallest debts first, which can provide psychological boosts as each debt is cleared. In contrast, the debt avalanche method prioritizes paying off debts with the highest interest rates first, potentially saving more money in the long run. Negotiating with creditors can also be a powerful tool in your debt management strategy. By reaching out to creditors, you may be able to negotiate lower interest rates or more manageable payment terms. Consolidation and refinancing are additional options that can help simplify and potentially reduce the cost of your debt. Evaluating the pros and cons of these methods can help you choose the most effective strategy for your situation. A well-crafted budget is a cornerstone of financial stability and wealth building. Creating a realistic budget involves tracking your income and expenses to ensure that your spending aligns with your financial goals. Start by documenting all sources of income and categorizing your expenses. Tools such as budgeting apps or spreadsheets can aid in this process, making it easier to identify areas where you can cut back. Tracking your expenses and income allows you to see where your money goes and adjust your spending habits accordingly. It's also important to adjust your budget as needed, especially in response to changes in your financial situation or goals. Regularly reviewing and updating your budget helps keep you on track and ensures that you're making progress toward your financial objectives. An emergency fund is essential for financial security and peace of mind. Its primary purpose is to cover unexpected expenses, such as medical bills or car repairs, without derailing your financial plans. Setting up an emergency fund involves determining a target amount, typically three to six months' worth of living expenses, and consistently contributing to it. Growing your emergency fund requires regular deposits, which can be facilitated by automating transfers from your checking account. Knowing when and how to use your emergency fund is also crucial; it should be reserved for genuine emergencies and not used for planned expenses or luxuries. By maintaining an emergency fund, you safeguard yourself against financial setbacks and reinforce your overall financial stability. Investing is a vital component of building long-term wealth and achieving financial independence. Understanding different investment options, such as stocks, bonds, mutual funds, and real estate, helps you make informed decisions that align with your financial goals. Diversification is key to managing investment risk; spreading your investments across various asset classes can protect you from market volatility. Setting clear investment goals ensures that your investment strategy is tailored to your specific needs, whether you're focused on growth, income, or a combination of both. Regularly reviewing and adjusting your investment portfolio is important to stay aligned with your goals and market conditions. Effective investment planning supports your journey from debt to wealth by helping you accumulate assets and achieve financial security. Financial literacy is essential for making informed decisions and navigating the complexities of personal finance. Educational resources, such as books, online courses, and financial blogs, can provide valuable insights and knowledge. Staying informed about financial trends and market developments helps you adapt to changes and seize opportunities. Consulting a financial coach can offer personalized guidance and strategies tailored to your unique situation. By continuously enhancing your financial literacy, you empower yourself to manage your finances more effectively and make strategic decisions that support your long-term goals. This knowledge equips you with the tools needed to maintain financial stability and work towards wealth building. Creating a long-term financial plan is crucial for sustaining wealth and achieving your financial goals. This plan should outline your objectives, strategies, and timelines, providing a roadmap for your financial journey. Regular financial reviews allow you to evaluate your progress and make necessary adjustments to stay on track. Adapting your financial strategy to life changes, such as a new job or significant expenses, ensures that your plan remains relevant and effective. By focusing on both short-term and long-term goals, you can build a resilient financial foundation that supports ongoing success. Consistently implementing and refining your financial strategies will lead to a more secure and prosperous future.Understanding the Debt Cycle

Setting the Stage for Financial Transformation

Strategic Debt Management Techniques

Developing Effective Budgeting Skills

Building and Maintaining an Emergency Fund

Investing for Long-Term Wealth

Enhancing Your Financial Literacy

Building a Sustainable Financial Future

Recent Articles

Creating Lasting Change: The Importance of Self-Identity in Personal Development

The Role of Self-Identity in P...

![]() Sep 03, 2024

Sep 03, 2024

The Power of Mindset: Overcoming Limiting Beliefs for Personal Growth

Understanding Limiting Beliefs...

![]() Sep 02, 2024

Sep 02, 2024

Navigating Financial Challenges: Proven Methods for Overcoming Barriers

Financial challenges can feel ...

![]() Sep 01, 2024

Sep 01, 2024

Why Empathy and Active Listening Are Crucial in Coaching Relationships

The Role of Empathy in Coachin...

![]() Aug 31, 2024

Aug 31, 2024

Mastering Money Mindset: How Your Beliefs Impact Your Financial Decisions

Understanding how your mindset...

![]() Aug 30, 2024

Aug 30, 2024

The Intersection of Health, Wellness, and Financial Empowerment

Understanding the Connection B...

![]() Aug 29, 2024

Aug 29, 2024

How Mindset Coaching Can Help You Find Fulfilment in Your Career

Mindset coaching is an innovat...

![]() Aug 28, 2024

Aug 28, 2024

Achieving Work-Life Balance with Mindset and Financial Coaching

The Importance of Work-Life Ba...

![]() Aug 27, 2024

Aug 27, 2024

Unlock Your Potential: How Mindset Coaching Can Transform Your Life

Understanding Mindset Coaching...

![]() Aug 26, 2024

Aug 26, 2024

Developing Resilience Through Mindset Coaching: Lessons from a Former Nurse and Soldier

The Power of Resilience in Per...

![]() Aug 24, 2024

Aug 24, 2024

Financial Freedom Starts Here: Essential Tips from a Financial Coach

Understanding Financial Freedo...

![]() Aug 23, 2024

Aug 23, 2024

The Role of Self-Reflection in Mindset Transformation

Understanding Self-ReflectionS...

![]() Aug 22, 2024

Aug 22, 2024

How to Create Effective Spending and Saving Goals That Align with Your Values

Understanding the Importance o...

![]() Aug 21, 2024

Aug 21, 2024

Breaking Through Barriers: How Mindset Coaching Helps You Achieve Your Dreams

The Power of Mindset in Achiev...

![]() Aug 20, 2024

Aug 20, 2024

Setting Healthy Boundaries for Personal Growth: Insights from a Mindset Coach

Understanding the Concept of B...

![]() Aug 19, 2024

Aug 19, 2024

The Benefits of Combining Mindset and Financial Coaching for Holistic Success

Achieving true success involve...

![]() Aug 18, 2024

Aug 18, 2024

Building Confidence Through Mindset Coaching: Strategies for Success

Understanding Mindset Coaching...

![]() Aug 17, 2024

Aug 17, 2024

Personal Development Through Financial Coaching: What You Need to Know

The Role of a Financial Coach ...

![]() Aug 16, 2024

Aug 16, 2024

Practical Steps for Building Wealth: Financial Coaching Strategies That Work

Understanding Wealth BuildingW...

![]() Aug 15, 2024

Aug 15, 2024

Transform Your Financial Life: Key Principles for Effective Budgeting and Investing

Understanding Financial Transf...

![]() Aug 14, 2024

Aug 14, 2024

Aligning Your Values with Financial Goals: A Guide to Financial Wellness

Understanding the Connection B...

![]() Aug 13, 2024

Aug 13, 2024

The Essential Guide to Financial Coaching: Unlocking Your Path to Financial Wellness

Understanding Financial Coachi...

![]() Aug 12, 2024

Aug 12, 2024