Financial Freedom Starts Here: Essential Tips from a Financial Coach

![]() Zin Lyons

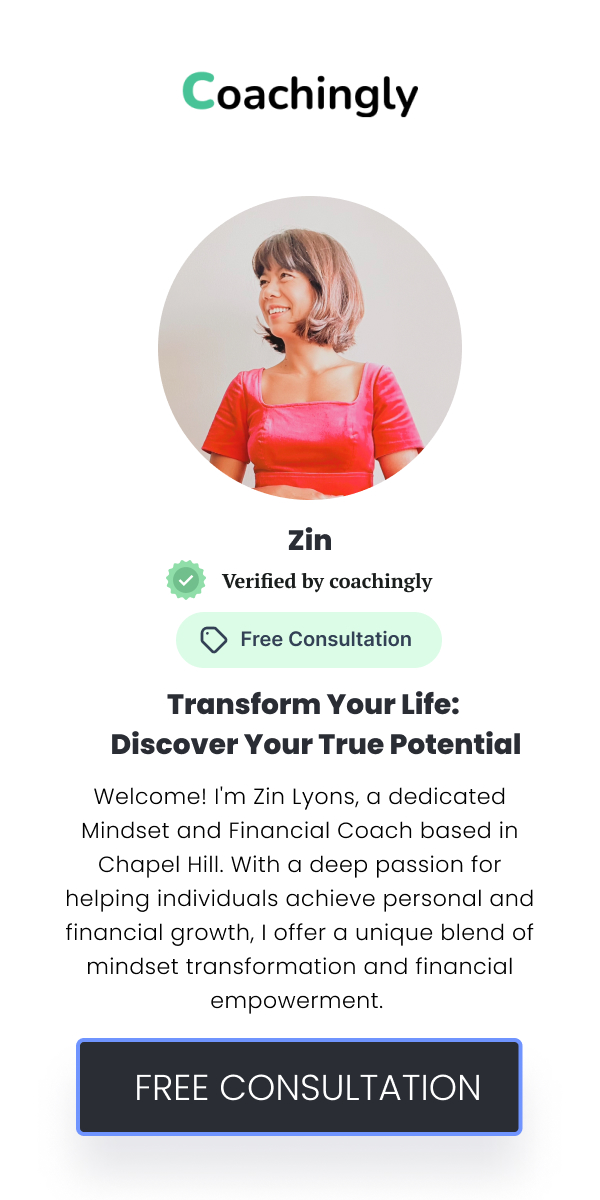

Zin Lyons

![]() August 23, 2024

August 23, 2024

Financial freedom represents a state where individuals have sufficient income and resources to cover their living expenses without needing to work continuously. It's a desirable milestone that provides the flexibility to make life choices based on personal preferences rather than financial constraints. Achieving financial freedom means having the autonomy to pursue passions, travel, or simply enjoy life without the stress of financial limitations. It also signifies a robust financial foundation that can weather economic uncertainties and unexpected expenses. The path to this freedom involves setting clear goals, strategic planning, and disciplined financial management. Understanding what financial freedom looks like and its benefits is the first step towards realizing this goal. Embracing this concept can lead to enhanced personal satisfaction and greater control over one's future. A financial coach is a professional who guides individuals in managing their finances effectively and achieving their financial objectives. Unlike financial advisors, who primarily focus on investment advice, financial coaches provide broader support that includes budgeting, debt management, and goal setting. They offer tailored strategies that fit individual financial situations and long-term aspirations. Through personalized coaching, clients receive practical advice on how to manage their money, reduce debt, and save for future needs. Financial coaches also hold clients accountable, helping them stay on track with their financial plans. Their role is to empower clients to make informed decisions and develop the skills necessary for financial independence. Engaging with a financial coach can significantly enhance one's ability to navigate financial challenges and seize opportunities. Establishing clear and achievable financial goals is fundamental to the journey towards financial freedom. Goals provide direction and motivation, helping to prioritize financial activities and allocate resources effectively. Start by identifying both short-term objectives, such as saving for a vacation or paying off a small debt, and long-term aspirations, like purchasing a home or funding retirement. Break these goals down into actionable steps and set deadlines to maintain focus. Regularly review and adjust your goals as circumstances change to ensure they remain relevant and attainable. Use these goals as benchmarks to measure your progress and celebrate milestones along the way. Clearly defined goals will help you maintain momentum and stay committed to your financial journey. Developing a budget is a crucial step in managing your finances and achieving financial freedom. A budget helps track income and expenses, ensuring that you live within your means and save for future needs. Begin by listing all sources of income and categorizing your expenditures, including fixed costs like rent and variable expenses such as dining out. Allocate funds for savings and debt repayment, prioritizing these categories to build a solid financial foundation. Use budgeting tools or apps to monitor your spending and identify areas where you can cut back. Regularly review your budget to adapt to changes in your financial situation and adjust your spending habits accordingly. Adhering to a well-planned budget will provide control over your finances and support long-term financial goals. An emergency fund is a financial safety net designed to cover unexpected expenses, such as medical emergencies or car repairs. Building and maintaining this fund is essential for financial stability and peace of mind. Start by setting aside a small, manageable amount each month until you reach your target savings goal. Aim to accumulate three to six months' worth of living expenses to ensure you're adequately prepared for unforeseen events. Keep your emergency fund in a separate, easily accessible account to avoid the temptation to dip into it for non-emergencies. Regularly replenish the fund as you use it to maintain its purpose. Having an emergency fund allows you to handle financial surprises without derailing your overall financial plan. Effective debt management is critical for achieving financial freedom and avoiding unnecessary financial strain. Begin by assessing your current debt situation, including outstanding balances, interest rates, and payment terms. Prioritize high-interest debts, such as credit card balances, and focus on paying them off as quickly as possible. Consider consolidating debts or negotiating with creditors for better terms if necessary. Develop a repayment plan that allocates additional funds towards reducing debt while maintaining regular minimum payments. Avoid accumulating new debt by practicing disciplined spending and using credit responsibly. Successfully managing and reducing debt will improve your financial health and bring you closer to financial freedom. Investing wisely is a key component of building wealth and achieving financial independence. Start by educating yourself on basic investment principles, including risk management and asset allocation. Diversify your investments across various asset classes, such as stocks, bonds, and real estate, to spread risk and enhance potential returns. Consider both short-term and long-term investment strategies to align with your financial goals. Regularly review and adjust your investment portfolio based on performance and changes in your financial situation. Seek professional advice if needed to make informed investment decisions. Strategic investing will help you grow your wealth over time and secure a comfortable financial future. Planning for retirement is crucial for ensuring long-term financial stability and security. Start by estimating your retirement needs based on your desired lifestyle and anticipated expenses. Contribute regularly to retirement accounts, such as pensions or individual retirement savings plans, to build a substantial nest egg. Take advantage of employer matching contributions and tax benefits associated with retirement accounts. Revisit your retirement plan periodically to adjust contributions and investment strategies based on changing circumstances and market conditions. Starting early and consistently saving for retirement will provide the financial resources needed for a comfortable and enjoyable retirement. Effective retirement planning is essential for achieving lasting financial independence. Financial landscapes and personal circumstances evolve, making continual learning and adaptation essential for sustained financial success. Stay informed about changes in financial regulations, investment opportunities, and economic trends that may impact your financial plans. Regularly review your financial strategies and adjust them to reflect new information or life changes. Engage in financial education through books, seminars, or courses to enhance your knowledge and skills. Adaptability ensures that your financial plan remains relevant and effective in achieving your goals. Embracing a mindset of continuous improvement will help you navigate challenges and seize new opportunities as they arise. A positive money mindset significantly influences financial decisions and overall success. Cultivating this mindset involves recognizing and challenging negative beliefs about money that may hinder progress. Focus on developing a constructive attitude towards financial management and opportunities. Practice gratitude and visualization techniques to reinforce a positive outlook on money. A healthy money mindset encourages responsible financial behaviors and supports long-term goals. By fostering confidence and resilience, you'll enhance your ability to make sound financial decisions and overcome obstacles. Embracing a positive mindset will contribute to greater financial stability and personal satisfaction. Limiting beliefs about money can impede financial growth and hinder your ability to achieve financial freedom. Common misconceptions include beliefs that financial success is unattainable or that money is inherently negative. Address these beliefs by identifying their origins and challenging their validity. Engage in self-reflection and seek professional guidance to reframe your perspective on money. Focus on building self-efficacy and taking actionable steps towards financial goals. Shifting your beliefs and attitudes towards money will enable you to pursue financial opportunities and overcome barriers. Developing a healthier relationship with money is essential for realizing your financial aspirations. Taking initial steps towards financial freedom involves setting actionable goals and creating a clear plan. Begin by evaluating your current financial situation and identifying areas for improvement. Establish short-term and long-term goals that align with your financial aspirations. Create a detailed action plan that outlines steps for budgeting, saving, and investing. Start implementing these steps immediately to build momentum and make tangible progress. Regularly track your progress and adjust your plan as needed to stay on course. Taking proactive measures will set you on the path to financial freedom and help you achieve your goals. Utilizing resources and tools can enhance your efforts toward financial freedom. Explore financial planning tools and apps that assist with budgeting, tracking expenses, and managing investments. Consider seeking out educational materials, such as books and online courses, to expand your financial knowledge. Join financial communities or forums to connect with others on similar journeys and gain insights from their experiences. Accessing these resources will provide valuable support and guidance throughout your financial journey. Staying informed and equipped with the right tools will facilitate your progress towards achieving financial independence.Understanding Financial Freedom

The Role of a Financial Coach

Essential Tips for Achieving Financial Freedom

Setting Clear Financial Goals

Creating a Budget and Sticking to It

Building an Emergency Fund

Managing and Reducing Debt

Investing Wisely

Strategies for Long-Term Financial Stability

Saving for Retirement

Continual Learning and Adaptation

The Impact of Mindset on Financial Success

Cultivating a Positive Money Mindset

Overcoming Limiting Beliefs About Money

Practical Steps to Start Your Journey

First Steps to Financial Freedom

Resources and Tools to Support Your Journey

Recent Articles

Creating Lasting Change: The Importance of Self-Identity in Personal Development

The Role of Self-Identity in P...

![]() Sep 03, 2024

Sep 03, 2024

The Power of Mindset: Overcoming Limiting Beliefs for Personal Growth

Understanding Limiting Beliefs...

![]() Sep 02, 2024

Sep 02, 2024

Navigating Financial Challenges: Proven Methods for Overcoming Barriers

Financial challenges can feel ...

![]() Sep 01, 2024

Sep 01, 2024

Why Empathy and Active Listening Are Crucial in Coaching Relationships

The Role of Empathy in Coachin...

![]() Aug 31, 2024

Aug 31, 2024

Mastering Money Mindset: How Your Beliefs Impact Your Financial Decisions

Understanding how your mindset...

![]() Aug 30, 2024

Aug 30, 2024

The Intersection of Health, Wellness, and Financial Empowerment

Understanding the Connection B...

![]() Aug 29, 2024

Aug 29, 2024

How Mindset Coaching Can Help You Find Fulfilment in Your Career

Mindset coaching is an innovat...

![]() Aug 28, 2024

Aug 28, 2024

Achieving Work-Life Balance with Mindset and Financial Coaching

The Importance of Work-Life Ba...

![]() Aug 27, 2024

Aug 27, 2024

Unlock Your Potential: How Mindset Coaching Can Transform Your Life

Understanding Mindset Coaching...

![]() Aug 26, 2024

Aug 26, 2024

From Debt to Wealth: Transformative Financial Strategies for Lasting Change

Understanding the Debt CycleDe...

![]() Aug 25, 2024

Aug 25, 2024

Developing Resilience Through Mindset Coaching: Lessons from a Former Nurse and Soldier

The Power of Resilience in Per...

![]() Aug 24, 2024

Aug 24, 2024

The Role of Self-Reflection in Mindset Transformation

Understanding Self-ReflectionS...

![]() Aug 22, 2024

Aug 22, 2024

How to Create Effective Spending and Saving Goals That Align with Your Values

Understanding the Importance o...

![]() Aug 21, 2024

Aug 21, 2024

Breaking Through Barriers: How Mindset Coaching Helps You Achieve Your Dreams

The Power of Mindset in Achiev...

![]() Aug 20, 2024

Aug 20, 2024

Setting Healthy Boundaries for Personal Growth: Insights from a Mindset Coach

Understanding the Concept of B...

![]() Aug 19, 2024

Aug 19, 2024

The Benefits of Combining Mindset and Financial Coaching for Holistic Success

Achieving true success involve...

![]() Aug 18, 2024

Aug 18, 2024

Building Confidence Through Mindset Coaching: Strategies for Success

Understanding Mindset Coaching...

![]() Aug 17, 2024

Aug 17, 2024

Personal Development Through Financial Coaching: What You Need to Know

The Role of a Financial Coach ...

![]() Aug 16, 2024

Aug 16, 2024

Practical Steps for Building Wealth: Financial Coaching Strategies That Work

Understanding Wealth BuildingW...

![]() Aug 15, 2024

Aug 15, 2024

Transform Your Financial Life: Key Principles for Effective Budgeting and Investing

Understanding Financial Transf...

![]() Aug 14, 2024

Aug 14, 2024

Aligning Your Values with Financial Goals: A Guide to Financial Wellness

Understanding the Connection B...

![]() Aug 13, 2024

Aug 13, 2024

The Essential Guide to Financial Coaching: Unlocking Your Path to Financial Wellness

Understanding Financial Coachi...

![]() Aug 12, 2024

Aug 12, 2024