Aligning Your Values with Financial Goals: A Guide to Financial Wellness

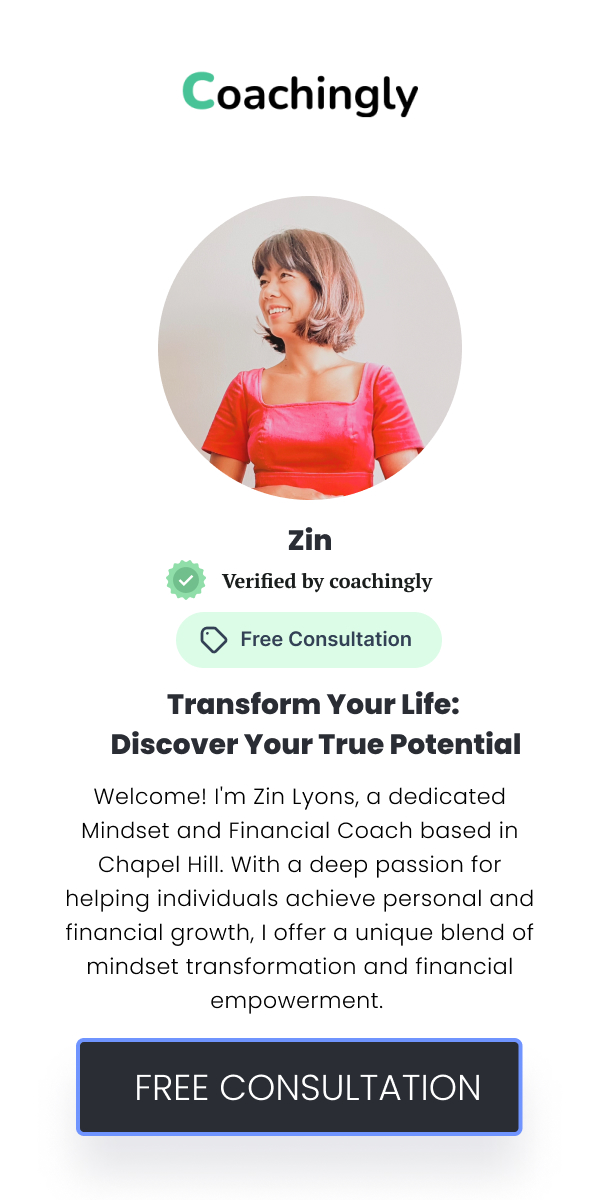

![]() Zin Lyons

Zin Lyons

![]() August 13, 2024

August 13, 2024

Our values are the compass guiding our actions, shaping our decisions and influencing how we manage our finances. Values are deeply personal and vary from one individual to another, encompassing aspects like family, career, health, and personal growth. These core principles not only reflect what is important to us but also significantly impact our financial decisions. When we make financial choices that align with our values, we create a sense of purpose and satisfaction in our financial journey. Conversely, financial goals that conflict with our core values can lead to stress, dissatisfaction, and a feeling of disconnection. Understanding the link between values and financial goals is crucial for achieving a balanced and fulfilling financial life. By recognising this connection, you can tailor your financial strategies to support what truly matters to you, leading to more meaningful and effective financial planning. To align your financial goals with your core values, start by identifying what truly matters to you. Begin with reflective exercises to explore your beliefs and priorities. Ask yourself questions like, "What do I value most in life?" and "What drives my decisions and actions?" Write down your answers and look for common themes or patterns. This process might reveal values such as family security, health, or environmental sustainability. Understanding these core values will provide a foundation for setting financial goals that resonate with your personal principles. For example, if family security is a top priority, you might focus on saving for future education or creating an emergency fund. By clearly defining your core values, you can ensure that your financial goals are aligned with what is most important to you. With your core values identified, the next step is to evaluate your current financial situation. Assess your existing financial goals, budgets, and strategies to determine whether they reflect your values. This assessment involves reviewing your spending habits, savings patterns, and investment choices. Are there discrepancies between your financial practices and your core values? For instance, if your values emphasize sustainability but your investments are primarily in non-eco-friendly companies, this might signal a need for adjustment. Tools such as budgeting apps and financial statements can help you gain insights into your financial health. By identifying any misalignments, you can begin to make adjustments that better align your financial activities with your personal values. Formulating financial goals that reflect your core values involves a thoughtful approach. Start by setting goals that resonate with what you identified as important. Consider both short-term and long-term goals to balance immediate desires with long-term aspirations. For example, if personal growth is a core value, you might set goals for further education or skills development. Prioritizing these goals requires understanding which ones are most crucial to your overall sense of fulfillment and well-being. Use SMART (Specific, Measurable, Achievable, Relevant, Time-bound) criteria to ensure that your goals are clear and actionable. Aligning your financial goals with your values ensures that your financial plan supports your broader life objectives, providing motivation and a sense of purpose in your financial decisions. Developing a financial plan that incorporates your core values is essential for achieving long-term financial wellness. Start by integrating your value-based goals into your budgeting process. This might involve allocating funds towards initiatives that align with your values, such as ethical investments or charitable donations. Implementing a budget that reflects your priorities ensures that your spending and saving align with your values. Consider investment strategies that support your values, like socially responsible investing, which allows you to invest in companies that align with ethical or environmental standards. Regularly review and adjust your financial plan to maintain alignment with your evolving values and goals. A value-driven financial plan helps create a cohesive strategy that supports both your financial and personal aspirations. Putting your value-based financial plan into action requires commitment and regular monitoring. Begin by executing the steps outlined in your financial plan, such as adjusting your budget and reallocating investments. Establish a routine for reviewing your financial progress, ensuring that your actions continue to align with your values. Tools like financial tracking apps and periodic financial reviews can help you stay on track. Monitor any changes in your values or financial situation that may necessitate adjustments to your plan. Regular check-ins allow you to make informed decisions and stay aligned with your core principles. By consistently implementing and monitoring your financial plan, you can maintain alignment with your values and achieve long-term financial wellness. Aligning your financial goals with your values may present various challenges. Common obstacles include limited resources, changing priorities, and conflicting financial demands. To address these challenges, develop strategies for maintaining focus on your values while navigating financial constraints. For example, create a prioritization framework to balance competing goals and allocate resources effectively. Stay committed to your value-based financial plan by regularly revisiting and adjusting your goals as needed. Seek guidance from a financial coach if you need support in overcoming specific hurdles. A financial coach can provide valuable insights and strategies to help you stay aligned with your values. By proactively addressing challenges, you can ensure that your financial goals continue to reflect your core values and support your overall well-being. Illustrative examples can provide valuable insights into the practical application of values-driven financial planning. Consider how individuals prioritize their financial goals based on their core values. For instance, someone who values environmental sustainability might focus on green investments or sustainable living practices. Another individual who prioritizes family might invest in education savings plans or secure a reliable health insurance policy. These examples demonstrate how aligning financial goals with personal values can lead to more fulfilling and purpose-driven financial management. By exploring different approaches, you can gain inspiration for creating a financial plan that supports your own values. Emphasizing practical applications helps to illustrate the benefits of a value-driven approach to financial wellness.Understanding the Connection Between Values and Financial Goals

Identifying Your Core Values

Assessing Your Current Financial Situation

Setting Financial Goals Aligned with Your Values

Creating a Financial Plan That Reflects Your Values

Implementing and Monitoring Your Value-Based Financial Plan

Overcoming Challenges in Aligning Values with Financial Goals

Real-Life Examples of Values-Driven Financial Planning

Recent Articles

Creating Lasting Change: The Importance of Self-Identity in Personal Development

The Role of Self-Identity in P...

![]() Sep 03, 2024

Sep 03, 2024

The Power of Mindset: Overcoming Limiting Beliefs for Personal Growth

Understanding Limiting Beliefs...

![]() Sep 02, 2024

Sep 02, 2024

Navigating Financial Challenges: Proven Methods for Overcoming Barriers

Financial challenges can feel ...

![]() Sep 01, 2024

Sep 01, 2024

Why Empathy and Active Listening Are Crucial in Coaching Relationships

The Role of Empathy in Coachin...

![]() Aug 31, 2024

Aug 31, 2024

Mastering Money Mindset: How Your Beliefs Impact Your Financial Decisions

Understanding how your mindset...

![]() Aug 30, 2024

Aug 30, 2024

The Intersection of Health, Wellness, and Financial Empowerment

Understanding the Connection B...

![]() Aug 29, 2024

Aug 29, 2024

How Mindset Coaching Can Help You Find Fulfilment in Your Career

Mindset coaching is an innovat...

![]() Aug 28, 2024

Aug 28, 2024

Achieving Work-Life Balance with Mindset and Financial Coaching

The Importance of Work-Life Ba...

![]() Aug 27, 2024

Aug 27, 2024

Unlock Your Potential: How Mindset Coaching Can Transform Your Life

Understanding Mindset Coaching...

![]() Aug 26, 2024

Aug 26, 2024

From Debt to Wealth: Transformative Financial Strategies for Lasting Change

Understanding the Debt CycleDe...

![]() Aug 25, 2024

Aug 25, 2024

Developing Resilience Through Mindset Coaching: Lessons from a Former Nurse and Soldier

The Power of Resilience in Per...

![]() Aug 24, 2024

Aug 24, 2024

Financial Freedom Starts Here: Essential Tips from a Financial Coach

Understanding Financial Freedo...

![]() Aug 23, 2024

Aug 23, 2024

The Role of Self-Reflection in Mindset Transformation

Understanding Self-ReflectionS...

![]() Aug 22, 2024

Aug 22, 2024

How to Create Effective Spending and Saving Goals That Align with Your Values

Understanding the Importance o...

![]() Aug 21, 2024

Aug 21, 2024

Breaking Through Barriers: How Mindset Coaching Helps You Achieve Your Dreams

The Power of Mindset in Achiev...

![]() Aug 20, 2024

Aug 20, 2024

Setting Healthy Boundaries for Personal Growth: Insights from a Mindset Coach

Understanding the Concept of B...

![]() Aug 19, 2024

Aug 19, 2024

The Benefits of Combining Mindset and Financial Coaching for Holistic Success

Achieving true success involve...

![]() Aug 18, 2024

Aug 18, 2024

Building Confidence Through Mindset Coaching: Strategies for Success

Understanding Mindset Coaching...

![]() Aug 17, 2024

Aug 17, 2024

Personal Development Through Financial Coaching: What You Need to Know

The Role of a Financial Coach ...

![]() Aug 16, 2024

Aug 16, 2024

Practical Steps for Building Wealth: Financial Coaching Strategies That Work

Understanding Wealth BuildingW...

![]() Aug 15, 2024

Aug 15, 2024

Transform Your Financial Life: Key Principles for Effective Budgeting and Investing

Understanding Financial Transf...

![]() Aug 14, 2024

Aug 14, 2024

The Essential Guide to Financial Coaching: Unlocking Your Path to Financial Wellness

Understanding Financial Coachi...

![]() Aug 12, 2024

Aug 12, 2024